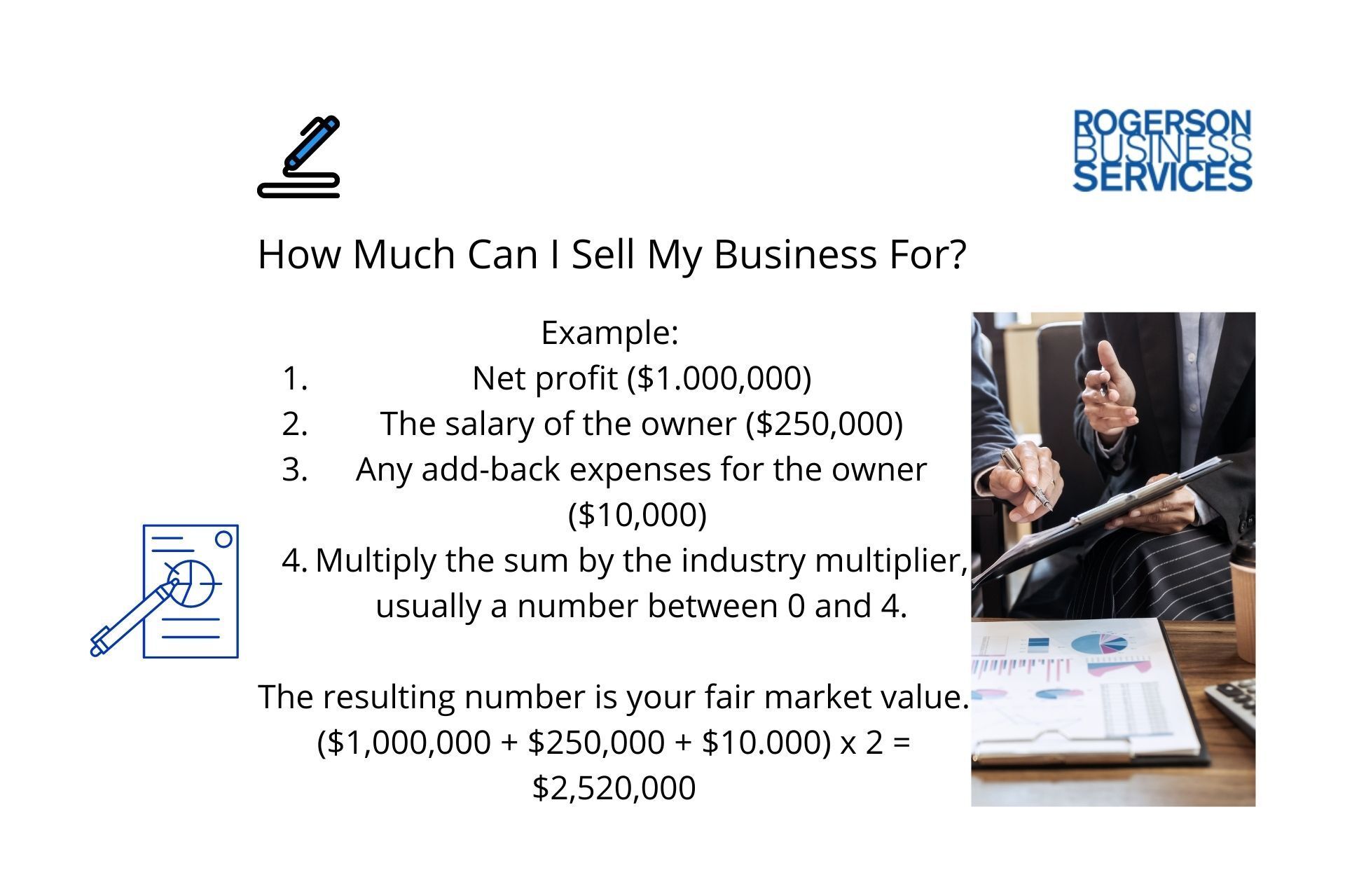

Business evaluation. This is the significant and sometimes, the trickiest part inside process of promoting a website. Keep in mind that the worth of one’s business will largely depend on the volume revenue you make, your assets and liabilities, your position in the industry, and the amount of cash that your potential buyers are prepared to spend to acquire your commercial.

It could be easy to see, especially after coaching and assisting numerous small sell my business owners across The united states. The ones that change the way they think, change their direction in life and homeowners who don’t continue down the actual same path and let obstacle after obstacle stop these products. They self sabotage and let their limiting beliefs, fear and doubt stop them from making empowering decisions in their life. However, you can overcome your fear, your doubt with your limiting beliefs through awareness, determination, coaching and learning new ability.

If business is slow with your industry but you are hanging on, and also like corporation as almost as much ast another career, then don’t auction. Get the marketing, accounting, coaching or other help to get out of your rut showcase it into the good a short time.

The last item tiny brief list, is actually getting said too often . out, if you would like many prospective buyers as we possibly can will grasp the business is good for sale. Any person can on the net and “list” their business for sale on numerous differing websites. Most of these sites will demand fees to search for the listing previously most favorable spot on the webpage. Some will lets you put the details on the website for costless. Access to this info in a position to restricted to registered site users in support of a small part of the listing information may see. When considering the costs of website listings, these relatively small in comparison to a broker’s premium.

Since many business owners are buyers, and industry is eventually sold or shut down, this is really a must lifestyles there is the who owns, plans to buy, or will eventually sell a business.

You do have to be very realistic in this particular matter, if. Look at the value of firm logically. Judge every regarding it to recognize what it worth. The particular market, the expenses and the gain a person simply acquire typically to assist you in making this picking. You need to know if your online business is in fact worth about you originally invested. If you don’t believe it is, you might allow it to grow a bit more time in order to sell your business for income.

Seller wants all cash: Here yet another deal killer – the seller needs all cash. No seller carry, and no loan. Easy here fairly obvious: not the case many individuals are sitting on tens to hundreds of thousands in cash, all set to wait. Usually those individuals are interested in buying bigger businesses, as well as using their cash as downpayments. When sellers get demanding on terms, especially in these leans times, their business available doesn’t demand much energy.

What else did I learn? I learned ways to maximize the cost of a target. I learned how to survey, up-sell, down-sell, cross-sell. I learned how promote better, mail better, call better. I learned tips on how to service clients better, increase retention, increase sales. I learned how to destroy monthly expenses and look after them moving down while ever-increasing that top line. I learned that the recurring revenue of $150,000 a month (which are usually way beyond at this point) can appear far more valuable rather than a non recurring revenue of $250,000. I also learned a little humility, are actually may now show very well.

What else did I learn? I learned ways to maximize the cost of a target. I learned how to survey, up-sell, down-sell, cross-sell. I learned how promote better, mail better, call better. I learned tips on how to service clients better, increase retention, increase sales. I learned how to destroy monthly expenses and look after them moving down while ever-increasing that top line. I learned that the recurring revenue of $150,000 a month (which are usually way beyond at this point) can appear far more valuable rather than a non recurring revenue of $250,000. I also learned a little humility, are actually may now show very well.